Mistakes to Avoid in a Market Downturn

I read an article recently that talked about the unprecedented levels of disruption to our way of life and the impact on global markets that have been hit by investor concern as a result of the spread of Covid-19. It looks at the common errors that investors will make before the markets rise again, along with some alternative courses of action to consider.

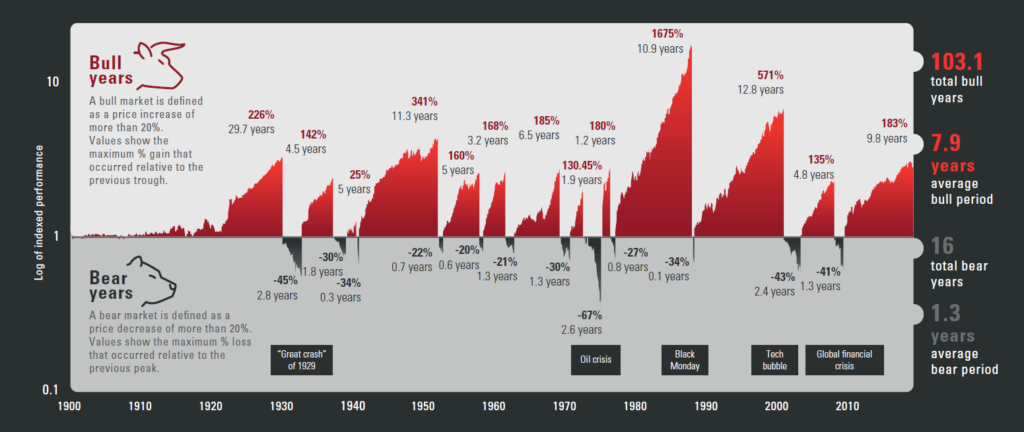

What really struck me was the graphic below that showed the Bull and Bear Markets since 1900 and the difference between the two namely, that there have been 103 years of Bull years and 8 years of Bear years. It puts things into perspective about the doom and gloom of the current impact by the pandemic on markets in the UK and that history has shown that the markets will recover following a crash.

Bear and Bull markets over time (UK)

Source: Vanguard Asset Management

Whilst there is, quite rightly, a massive concern for the current predicament that businesses find themselves in, there is an opportunity that once through this downturn, there is a period of growth to take advantage of. While there are many ways this downturn can impact your business in the short-term, it is important to separate permanent damage, which will impact the long-term, from temporary damage which will quickly be forgotten.

Reading through the article about the four mistakes that investors make in a market downturn, what resonated with me was how this is so relevant to businesses as well. These mistakes are listed below, along with my take on each one to give businesses something to think about.

1. FAILING TO HAVE A PLAN

Investor Mistake:

The first mistake in investing is doing so without a plan. It’s an error—often born of inertia or over-confidence—that invites other errors, such as chasing performance, trying to time the market or reacting to market “noise.” Such temptations multiply amid downturns, as investors looking to protect their portfolios seek quick fixes.

Rory’s Thinking for Businesses:

Do you have a plan for overcoming market downturns? We all get excited and giddy about the goal of growing our business, increasing its value, making shareholders happy and buying that fancy car, but that comes at the expense of the unexpected.

If you don’t have a plan, make one! Think about all the things that you wished, should and could have done before this downturn that would have put your business in a better position than you are in now. Who is aware of the plan? Did everyone contribute to the plan that needed to? Did everyone buy into the plan? When was the last time you updated the plan?

If you already have a plan, has it worked? What would you adapt and change to make it a better plan?

“Hope for the best and prepare for the worst.”

2. FIXATING ON ‘LOSSES’

Investor Mistake:

If you have a plan and a portfolio that’s balanced across asset classes (shares, bonds and cash) and diversified within them, but the portfolio’s value drops significantly in a market swoon, don’t despair. Stock downturns are normal, and most investors will endure many of them.

Rory’s Thinking for Businesses:

Even though you may be haemorrhaging cash, don’t fixate on how to save costs unilaterally, but think about the balance of your costs against your sales. At some point you need to come out of this downturn and if you have adversely affected the ability of the business to generate sales, then you will severely restrict your way out.

Think about where you can save on costs without it being too detrimental to the ‘machine that makes you money’ and instead use this time to work out ways of being more efficient. These sort of situations are sometimes the best times to find new solutions.

“You can almost never save your way to profitability.”

3. OVERREACTING OR MISSING AN OPPORTUNITY

Investor Mistake:

In times of falling asset prices, some investors overreact by selling riskier assets. It does sometimes take a market shock to alert investors to the risk in their portfolios. But it’s a mistake to sell risky assets amid market volatility in the belief that you’ll know when the time is right to move your money back to those assets. That’s called market timing, and the chart below shows one reason why it’s a bad idea. Extreme market movements, up and down, have often occurred in close proximity to one another, making it difficult to time the market.

Rory’s Thinking for Businesses:

When it seems like the world is closing in on you and your business there is a desire to want to react straight away but try and avoid making knee jerk reactions. The majority of situations do not require decisions to be made instantly and time needs to be taken to consider all the factors before jumping in.

Be aware of what is happening with all parts of your business and make sure that you have all the facts and information you need to make an informed decision. Take your time to assess the short, medium and long term effects of your decisions.

‘For every challenge, there’s an opportunity’ is a well-known phrase and now is the time to embrace it. If you are quick to react you will not have the bandwidth to be aware of them so, take stock and look at what opportunities there may be to take advantage of.

“Sometimes the easiest things to do in a downturn aren’t necessarily the best things to do.”

4. TRADING AMID VOLATILITY? CONSIDER THE OTHER SIDE …

Investor Mistake:

Not all investors sell risky assets during or after the market downturns, some went the other way — adding to their holdings of risky assets. Even during volatile periods, there are always ‘two sides of the trade’ — as some are selling, others are buying. It’s important for investors to realise this dynamic, especially those who may have strong feelings that ‘now’ is the time to sell.

Rory’s Thinking for Businesses:

The desire to want to be doing ‘something and quickly’ to try and overcome the current predicament is an overwhelming one but one you should try to overcome. The short-term and myopic view may seem to be the right course of action but winning the battle at the detriment to winning the war is a costly mistake.

Try and think about what you want to achieve, what good would look like when you come out the other side. Now is the time to take this into consideration before you commit to some major decisions that may not be reversible. This isn’t to say that dealing with the immediate challenge doesn’t need to be confronted however, try and balance the needs of the here and now with the needs of the future.

What is your goal? Is it to save the business? Is it to see you through the downturn? Is it a time to make that change, to go in a different direction? Have that clear in your mind and it will make decision making so much easier.

“Begin with the end in mind.”

What can YOU do to mitigate against market downturns?

At a high level, there are four things you should consider – The first two are integral to ensuring you have a robust, workable plan in place in case of the unexpected. The last two are required to ensure that all your actions contribute towards the potential long-term benefits of that plan.

It's all well and good to know what you should not do as a business owner …, but considering the above, what will you do now?

If you would like to learn more about how Wingman can help you deal with challenges you may be facing in your business, please get in touch.

Leave A Comment

You must be logged in to post a comment.